Will a US travel recession affect Costa Rica?

According to ICT (Instituto Costarricense de Turismo), there has not been a visible decrease in international arrivals in 2019 compared to last year. If you look at the statistics there has actually been an increase in international flights. This might be a good scenario considering that 75% of air travellers to Costa Rica come for tourism purposes.

Despite these positive factors, there are worrying signs about where worldwide demand is headed, and evidence suggests that the U.S. is poised for a slowdown across every travel category. As U.S. travellers continue to be the most frequent visitors to Costa Rica, we could be negatively affected by their situation.

This article in PhocusWire identifies some concerns. Among them:

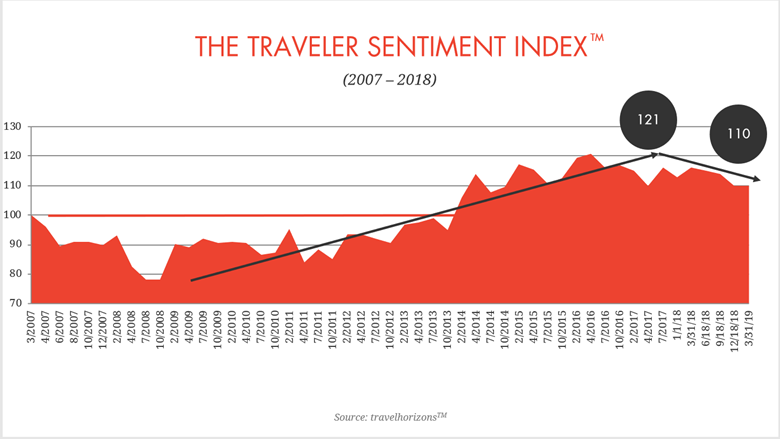

- The MMGY Global Traveler Sentiment Index (TSI) reports eight straight quarters of secular decline in US demand index; this suggests that U.S. intent for leisure travel has softened considerably.

- Prices are still rising in many cases, because commercial demand drop‐off is trailing leisure, so higher air fares and hotel rates remain in place, creating a further headwind for leisure demand.

- Economies around the world are softening, and travellers are on notice. Political and economic uncertainty, such as with Brexit and European disharmony, potential NAFTA rule tightening, and US/China trade relations, are making potential travellers uneasy.

- The balance of power for international travel share is shifting east. India and China, as well as emerging economies in the EMEA region and pan‐Asia, are fuelling growth in other parts of the world, meaning less proportional demand for traditional destinations.

What can we expect from this scenario as we move through 2019 and into 2020?

The article suggests the following:

- Leisure demand will contract below 2002 levels by early 2020, and corporate demand will follow by Q3 2020. There is good reason to believe that pockets of the market will remain strong, such as affluent travellers or the Mature age group.

- As a result, we will likely see what we commonly see in this tougher environment: a drop in fares and rates.

- It’s possible that the gains brand suppliers have made against third parties will be reversed. Especially in the hotel space and, as demand contracts, we would expect to see less revenue management discipline among suppliers.

- Amazon will move into the travel space and completely alter the landscape. There is no formal announcement or even tangible evidence that this is happening, but I still call it a certainty.

In a tightening economy, Amazon could become a better option for both consumers and suppliers looking to connect supply and demand.

Considering these factors, the United States economy could be affected by a drop off of flights to their country, and as the Costa Rican economy depends in big part of U.S. visitors, we could be affected.

However, the picture is not entirely bleak, as the article suggests that we might be seeing a change in the industry; it depends on how flexible and fast companies are to sense what the market is looking for and to make changes.

Perhaps it’s best to remain optimistic in times of potential crisis. Costa Rica is well known by U.S. and Canadian travellers for being an ecotourism destination, thanks to our biodiversity and conservation policies.